In 2009 the company changed its name to FGA Capital. Under this new name, signed a partnership with Chrysler to manage the financial services for the Chrysler, Jeep, and Dodge brands.

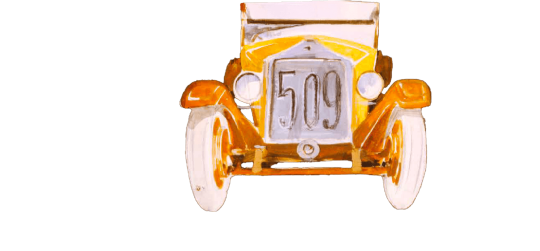

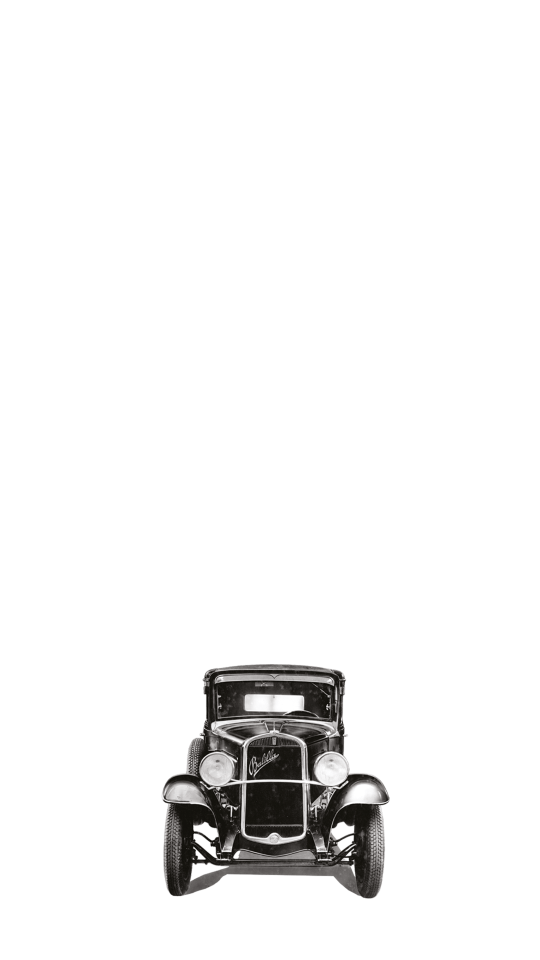

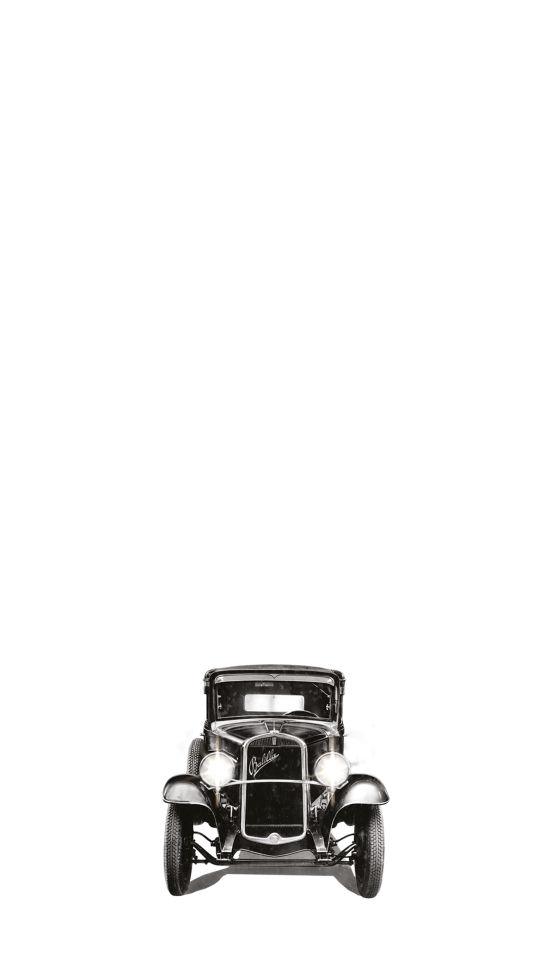

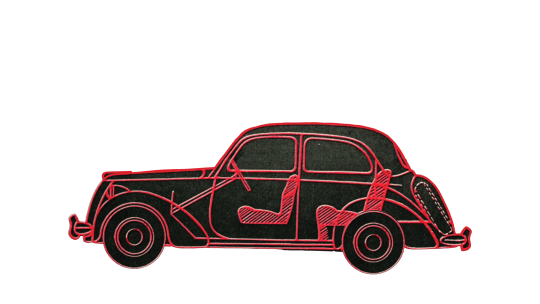

1932

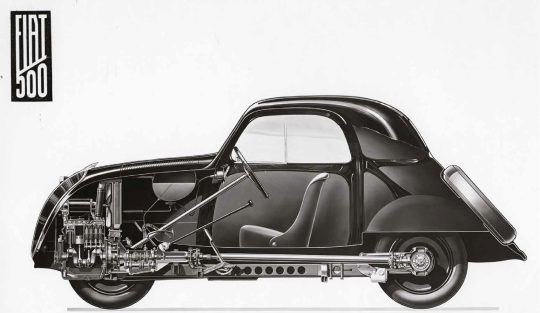

Fiat 508 “Balilla”. The first real “economy car”.

Priced at 10,800 lire it was accessible to the middle and lower bourgeoisie and became the symbol of Italy’s industrial growth and modernization.

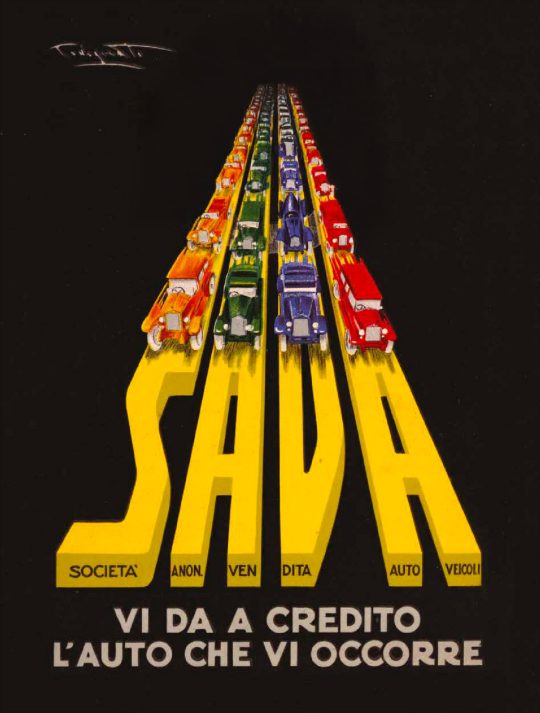

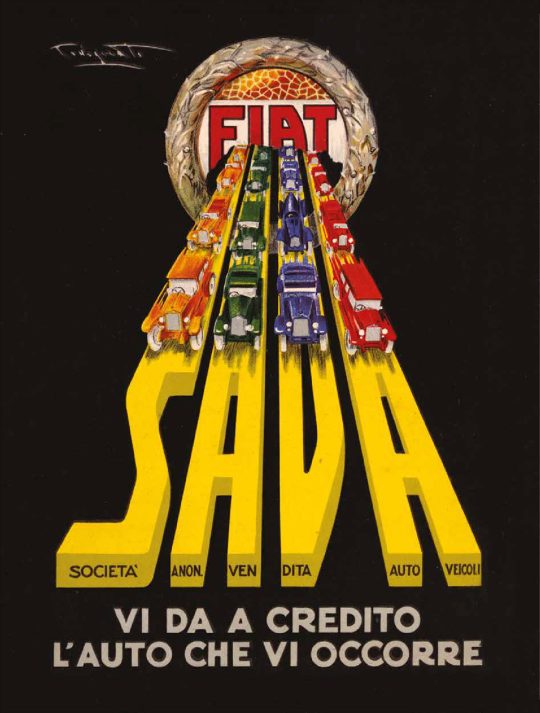

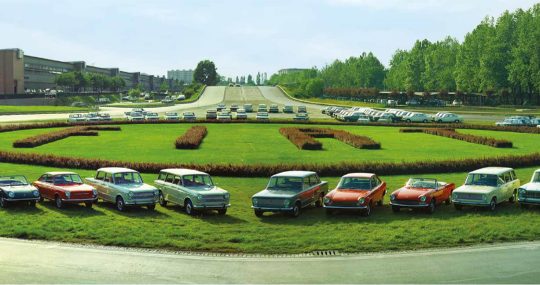

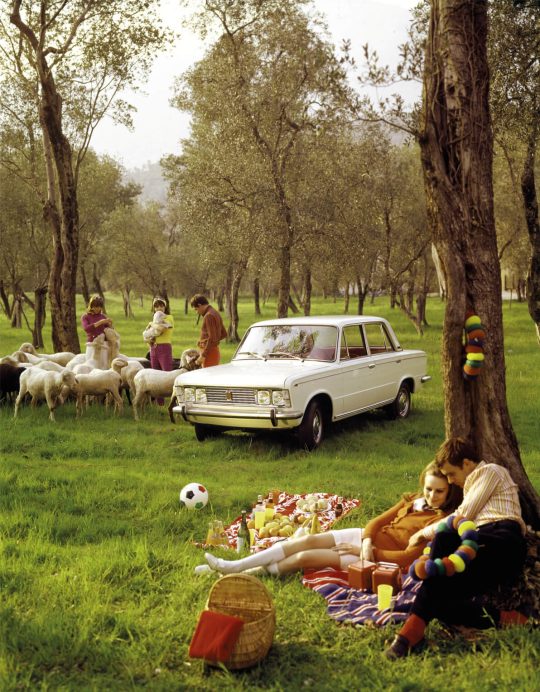

Between 1925 and 1939, the number of cars in Italy tripled, fueled by SAVA financing: in those years its share capital rose from 3 to 25 million lire.

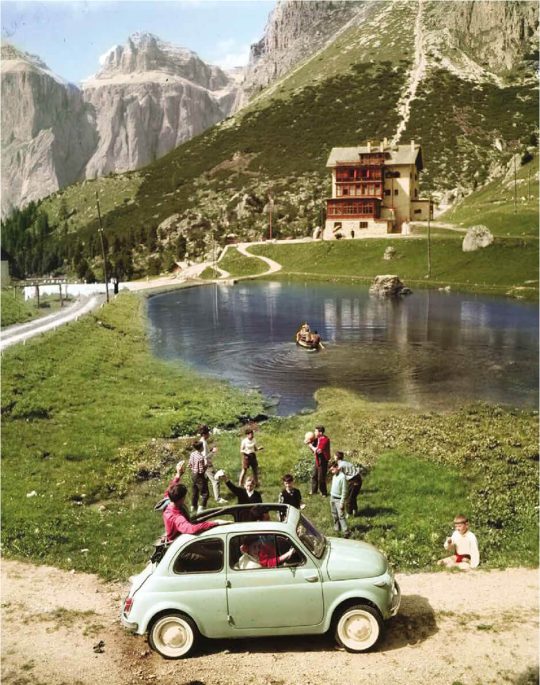

Automobiles overtook horse-drawn transportation, but true success awaited the first, truly affordable utility vehicle…